What Is An

Enstigate® Investigator?

Over the years we have come across so many products and services who claim to be the very best in what they do, but are they really?

Instead we Investigate each product and service, from every angle ensuring it truly is the best-of-the-best, in their respective industry. In many cases we are Boots-On-The-Ground (sometimes we go undercover) trying it out for extended time-frames.

We're going to try it out, verify it, and validate each claim of the product and/or service. Asking real customers about their true experiences and results. Even reading the tedious research papers and studies being used by the company to ensure it actually does what it says it will do.

Then if it passes all of our in-house tests and it's considered an industry leader in its respective category we will showcase our results and it will be placed into a customized media promotion campaign to hit the revenue goals of the business.

Website Presence

We help create an online website presence that truly represents what you do.

Growth Strategies

Over 8+ years of growing all types of businesses with our Enstigate® Methodology.

Investigate & Scale

We investigate your industry, showcase the results & then leverage it to hit your Goals.

OUR WEBSITE SERVICE HAS...

Important Benefits For Leveraging Your Time & Energy

Your website is more than an online presence its a full fledged team working behind the scenes, that can work in unison within your business model.

Time to leverage the power of real human beings setting up your specific automations, marketing, and sales tools to actually work for you!

No long learning curves or confusing technologies to waste your precious brain power on. We set it up for you and it works just like you want it too. Unlimited support to ensure we get it right so you can leverage your time and energy.

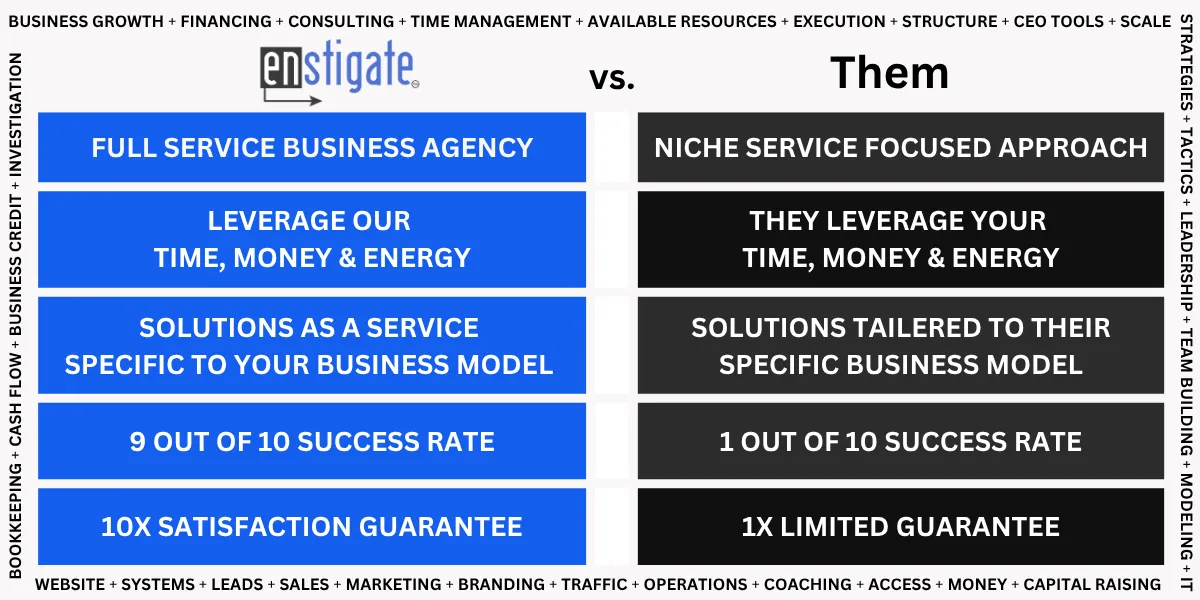

OUR GROWTH STRATEGIES...

Provides You A 9 Out Of 10 Success Rate

We have helped so many businesses over the last 8+ years grow. Our Enstigate® Methodology is so easy to implement into your existing structure.

We know what needs to be done and we just make a step-by-step plan to get it done with you. Imagine having the ultimate business partner who can do anything you need them to do to be successful. As the weeks go by it just gets done!

With this structure you can quickly grow without it hampering your time, money, or energy because these available resources are being instantly implemented into your business. Growth and Success is the End Result!

OUR ENSTIGATE® INVESTIGATORS ARE...

Experts In Finding True Solutions That Actually Work.

The competition in your market is always changing and it is very difficult to cut through the noise to reach your customers like it was years ago. Many times it takes an outside observer from your company to review and crack the code on what is going on in your business. Then take that information and assess the right next step to take to grow.

We specialize in helping you find and solve that right next step with our available resources. In basic terms, we help you overcome the limiting blocks or areas in your life and business.

Whether that is health, accounting, finance, funding, marketing, website presence, automation, product and service creation, sales, operations, etc. Regardless of what needs to be done we'll help you overcome the hurdle and move onto the next one so you hit your Goals in both Life and Business.

OUR BUSINESS MODEL...

Creates Win-Win Relationships

Everyone wins in this proven Business Model. Over the last 8+ years we have done some incredible things with all different types of businesses because the structure of the service is truly implementable and affordable for You the business owner.

Once you Submit a Request Form we'll begin to assess what your trying to do and if we can help you in any way possible. If we feel there is mutual interest we'll reach out to schedule a video call.

On the video call we'll go over everything and assess the right type of support you will need to advance to hit your Goals.

Don't make success complicated because it truly is easier than you think to experience with the right people to support you.

Our Enstigate® Team

Brian Rassi

CEO & Co-Founder

Kelly Ann Brown-Rassi

Chief Investigator & Co-Owner

The Enstigate® Support Team

We Have Growth Guides, Investigators, Marketing, and IT Specialists On Our Team That We Use To Support Our Clients As They Grow in their Life and Business.

en-sti-gate ® – (verb)

When Idea, Inspiration, and Innovation Collides with Enterprise and the Entrepreneurial Spirit.

Our Services

Website Presence

Our team will craft a successful online website presence for your company & brand.

Customized To Your Business

We will listen to how you run the business & craft the tools to work within it to save time.

Boost Your Revenue

Your clients will clearly be able to take action and they will not waste your time either.

Data & Tracking Analysis

Leverage data and tracking insights to drive informed business decisions of sales.

Growth Strategies

We have proven to increase businesses with a 9 out of 10 success rate with our strategies.

Media Promotion

Amplify your brand’s reach through effective multimedia campaigns and promotions.

Choose Your Plan

Website

$79/week

(52-week initial term)

New & Improved Website

Includes Copy Writers

Includes Graphic Design

Includes Automatons & Chat Bot

Includes Server & SSL

Includes Social Media Connections

Includes E-commerce Connections

Includes SMS Phone Number

Includes CRM for Your Sales Team

Access To AI Representatives

Dedicated Account Representative

Growth

$349/week

(52-week initial term)

Includes All Website Service Items

Deep Dive Into The Business Model

Bi-Weekly Live Video Consulting Calls

Strategic & Business Plan Consulting

Marketing & Sales Consulting

QuickBooks Consulting

Website Consulting

Finance & Funding Consulting

Technology Build-Out Consulting

Health & Wellness Plan Consulting

Access To Available Resources

Investigate

$999+/week

(52-week initial term)

Includes All Growth Service Items

Try The Products and Services

Boots-On-The-Ground

Validate The Claims And Research

Validate The Testimonials

In-Depth Comparative Analysis

Get A Report Showcasing The Results

Approved Online Designation

Data & Tracking Analysis

Boost Your Revenue

Media Promotion

Frequently Asked Questions

What Is The Enstigate® Methodology?

We all have something limiting us at any one particular time from growing in our life and business. We find and alleviate it with the right next step in your life and business allowing you to instantly grow. Then we keep doing it on a weekly basis until you can't even recognize where you started from with our support and available resources.

What Is Your Success Rate Over The Years?

We have a 9 out of 10 Success Rate over the years with our Enstigate® Methodology. Meaning if You have Goal(s) you want to accomplish with our support we have a proven track record of hitting that Goal(s) over 90% of the time by working together.

What Industries Do You Focus On?

We have accepted many different types of business industries over the years for our Website, Growth, and Investigate Packages. Submit a Request Form and we'll quickly be able to tell you if we feel its a good fit to work together.

Why Do You Do Weekly Payments?

We have found over the last 8+ years that when we align fully with our clients we have the best chance to succeed together. Everyone benefits from this payment structure because it keeps both parties integrated properly to continuously grow and accomplish the Goal(s) set forth.

Why A 52-Week Initial Term?

Every client is unique and needs support in different areas of their life and business. A lot of times as we both roll up our sleeves we uncover new areas that need to be addressed to grow and advance. As this continues the service needs time in order for everything to get implemented and take hold for a successful outcome.

How Do The Weekly Payments Work?

We collect your First & Last Payment upon the beginning of the term. Then every week we'll collect the same amount until the end of the term.

Do You Have Any Testimonials For Review?

Many of our clients have desired to give us positive testimonials over the years that we can supply upon request once we know there is a mutual interest in working together. We want to honor our clients privacy so they can focus on growing their business.

Do You Solicit and/or Accept Donations Of Any Kind?

No! This is our official website. Be aware of impersonators. We will never solicit you to text, call, or donate money to us. We are not apart of any Foundations to donate money too or accept money for. This is not a Non-Profit it is a Full Service Business Agency that focuses on helping other Businesses Grow and Scale. We are currently not on any social media at this time because of this exact reason. If you or anyone you know gets notified by an impersonator please contact us at [email protected] so we can notify the proper authorities.

Submit a Request

Fill out the request below and we will craft a solution for your needs.

In God We Trust and All Things Are Possible.

13475 Atlantic Blvd Unit 8 Suite 918, Jacksonville, FL 32225 | (833) 249-6368 | [email protected]

* This is our official website. Be aware of impersonators. We will never solicit you to text, call, or donate money to us. We are not apart of any Foundations to donate money too or accept money for. This is not a Non-Profit it is a Full Service Business Agency that focuses on helping other Businesses Grow and Scale. We are currently not on any social media at this time because of this exact reason. If you or anyone you know gets notified by an impersonator please contact us at [email protected] so we can notify the proper authorities.

© Copyright 2017-2025. Enstigate Entrepreneurs LLC. All Rights Reserved.